Liberty Reserve money-laundering: Is this the wild west of internet banking?

Source: The New York Times

The operators of a global currency exchange ran a $6 billion money-laundering operation online, a central hub for criminals trafficking in everything from stolen identities to child pornography, federal prosecutors in New York said.

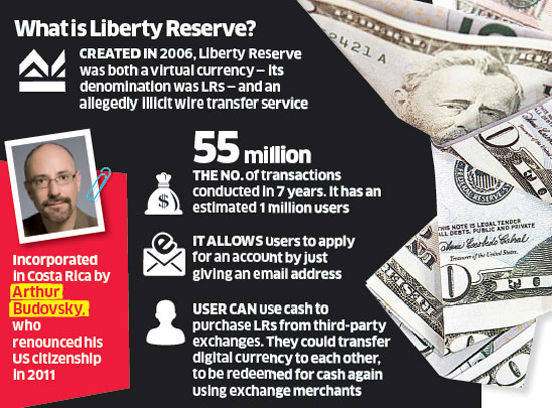

The currency exchange, Liberty Reserve, operated beyond the traditional confines of US and international banking regulations in what prosecutors called a shadowy netherworld of cyberfinance. It traded in virtual currency and provided anonymous and easily accessible banking infrastructure, law enforcement officials said.

The charges announced at a news conference by Preet Bharara, the US attorney in Manhattan, and other officials, mark what officials said was believed to be the largest online money-laundering case in history. They said over seven years, Liberty Reserve was responsible for laundering billions of dollars, conducting 55 million transactions that involved millions of customers around the world, including about 200,000 in the US.

Richard Weber, who heads the Internal Revenue Service's criminal investigation division in Washington, said the case heralds the arrival of "the cyber age of money laundering", in which criminals "are gravitating toward digital currency alternatives as a means to move, conceal and enjoy their illgotten gains".

Liberty Reserve surfaced as a preferred vehicle to transfer money in a number of high-profile cybercrimes, including the indictment of eight New Yorkers accused of helping to loot $45 million from ATMs in 27 countries, officials said.

Liberty Reserve was incorporated in Costa Rica in 2006 by Arthur Budovsky, who renounced his US citizenship in 2011. He was arrested in Spain on Friday. He was charged with conspiracy to commit money laundering and operating an unlicensed money-transmitting business.

Bharara said the exchange's clientele was largely made up of criminals, but he invited any legitimate users to contact his office to get their money back.

Liberty Reserve money-laundering: Is this the wild west of internet banking?

SIGN IN AS JOE BOGUS

The charges outlined how the money transfer system operated, offering a glimpse into the murky world of online financial transactions where money bounces between accounts from Cyprus to New York in the blink of an eye.

To transfer money using Liberty Reserve, a user needed only to provide a name, address and date of birth. But users were not required to validate their identity.

One undercover agent was able to register accounts under names like "Joe Bogus" and describe the purpose of the account as "for cocaine" without being questioned, officials said. That no-questions-asked verification system made Liberty Reserve the premier bank for cybercriminals, prosecutors said. Essentially, all a customer needed to open an account was an email address.

While Liberty Reserve was incorporated outside the US, federal officials used a provision in the Patriot Act to target the organisation and other financial institutions with whom they conducted business. It was the first time the provision had been used to prosecute a virtual currency provider, officials said.

- Login to post comments